Want celebrity gossip? The online destination of choice is PerezHilton.com - which, according to Perez, boasts larger readership than People Magazine (the perennial #1 print magazine). That success has turned Perez into a star - he has his own MTV and VH1 shows, is seen in celebrity magazines galore and he's fetching sponsorship deals both personally on on his website.

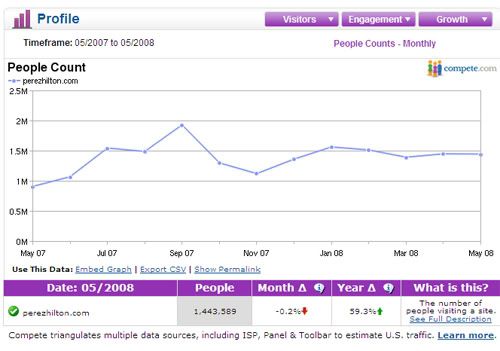

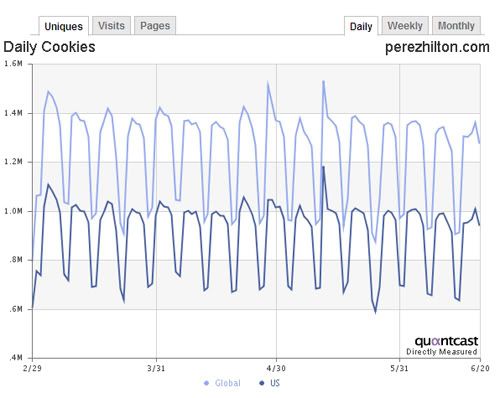

So you would think that PerezHilton.com would be growing because of all of this. Wrong. Pageviews, uniques and visits are relatively flat (perhaps even down).

Why? Simply put:because blogging doesn't scale.

As Perez Hilton becomes more of a star, his focus clearly has shifted. There are fewer daily blog posts and, more importantly, fewer 'meaningful' blog posts (there is now lots of content about Perez himself). There is only so much time in the day and only so much juicy gossip.

Meanwhile, there are ways to solve this. Blogs like TechCrunch, Valleywag and others are hiring full staffs and publishing content more regularly. In fact, PerezHilton.com is quickly taking a backseat to TMZ - which is using its growing staff to out-pace Perez on all fronts.

Gawker is another great example. Sites like DeadSpin.com have strong traffic in their verticals, but they too become flat over time. Growth then comes from the larger network and increase authorship. Kotaku.com, for instance, is surging and Valleywag.com is growing nicely behind it's increased authorship.

PerezHilton.com:

The GawkerNetwork:

Top Sites Reach Reach%

gizmodo.com 8,705,071 28.8%

lifehacker.com 5,701,369 18.8%

kotaku.com 4,498,218 14.9%

gawker.com 3,247,225 10.7%

fleshbot.com 2,137,780 7.1%

consumerist.com 1,966,213 6.5%

jalopnik.com 1,758,997 5.8%

defamer.com 1,721,438 5.7%

valleywag.com 1,304,718 4.3%

jezebel.com 1,297,423 4.3%

deadspin.com 1,231,847 4.1%

io9.com 1,154,466 3.8%

wonkette.com 961,723 3.2%

gridskipper.com 471,975 1.6%

idolator.com 319,265 1.1%

gawkershop.com 9,543 < 0.1%

gizmodo.net 8,145 < 0.1%