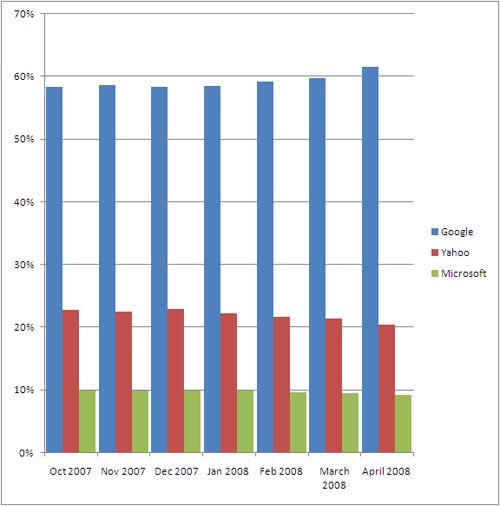

Interesting data out of Comscore and TechCrunch this morning that points to the slowing growth of paid search activity despite a rise in search activity. Comscore believes it is a consequence of longer search queries, but Michael Arrington has a larger picture answer (which I agree with):

U.S. Search queries are up 68% in the last year, but paid clicks are up only 18% in the same period...

he reason there are less ads on search results, I believe, is that there are, simply, less advertisers. Far less. Big spenders, the category leaders, are just gone. Sharper Image, Wickes Furniture, Levitz, Foot Locker, Wilson’s Leather, Ann Taylor, Zales, Mervyn’s, Macy’s, Circuit City and a ton of other retailers are either shutting down entirely or closing lots of stores. And more are on the way. All of these companies used to spend tons of money on paid search ads. Those budgets don’t exist any more.

Combine that with the fact that, as any paid search advertiser knows, it is downright hard to spend more money effectively. SMBs face the same problem: scaling paid search spend in both click volume and conversions.

And - let's not forget that the affiliate landscape is rapidly changing. Affiliates once accounted for a major portion of AdWords spend (either directly or by indirectly bloating the prices of keywords). As major affiliate programs have changed their policies (ie Amazin prohibiting paid search), an entire tier of sophisticated marketers disappeared.

So in a move that certainly is not coincidental, Google yesterday announced that AdWords advertisers can now bid on brand terms. Wow. That is a very significant change - both directionally and operationally (for advertisers and Google alike).

Brands spend countless hours protecting themselves. And that, until now, has included protecting themselves in paid search. Meanwhile, competitors or savvy arbitragers (affiliates, etc) have long capitalized on branded keywords. Early on at eBay, for instance, we had to specifically prohibit bidding on eBay's brand - which included numerous derivatives of eBay, Half.com, etc.

I am sure Google has operational reasons to allow brand bidding: it is both messy and intensive to protect the brand names (and not always accurate or fair). But this is clearly a move that is intended to drive revenue by reopening high-traffic keywords.

Expect related CPCs to rise, brands to complain loudly, and affiliates to scramble immediately.

I expected the lower trending for the under-25 crowd as that demographic grew up on Facebook and lives there. I would have expected that the 25-34 bracket would be Twitter's sweet spot - always online, early adopters and followers of pop-culture. But the 45-54 bracket is surprising... until you consider that marketers and companies indeed represent a significant portion of Twitter:

I expected the lower trending for the under-25 crowd as that demographic grew up on Facebook and lives there. I would have expected that the 25-34 bracket would be Twitter's sweet spot - always online, early adopters and followers of pop-culture. But the 45-54 bracket is surprising... until you consider that marketers and companies indeed represent a significant portion of Twitter: